Annuity Lifetime Income Riders: How Rollup Rate and Payout Rate Affect Income

Lifetime income riders offer guaranteed minimum lifetime income, but these two rates significantly affect the payout you receive.

Lifetime income riders offer guaranteed minimum lifetime income, but these two rates significantly affect the payout you receive.

An income rider is an optional annuity add-on guaranteeing that, once the annuity starts paying out, it will continue making regular payments for the rest of your lifetime even if the amount paid out surpasses the amount accumulated in your annuity.

The tricky part is this: income riders use a conceptual value called the benefit base (or income base, or payment base), which is a separate number from the actual accumulated value of your annuity, called the account or contract value. The amount paid to you in regular income is calculated using your benefit base, but payments will come out of your account balance, so they may eventually deplete it. If you live long enough to use up all the money accumulated in your account, then the payments will continue for your lifetime, but no funds will remain in your account to pass along to a beneficiary when you are gone. 1

However, let’s assume you are most interested in the actual payments you will receive during your lifetime, and you are comparing different products to determine the best one for you. Every company selling annuities offers different rollup rates and different payout rates, calculated in a variety of ways. If you want to be able to compare your options, you’ll need to do some math.

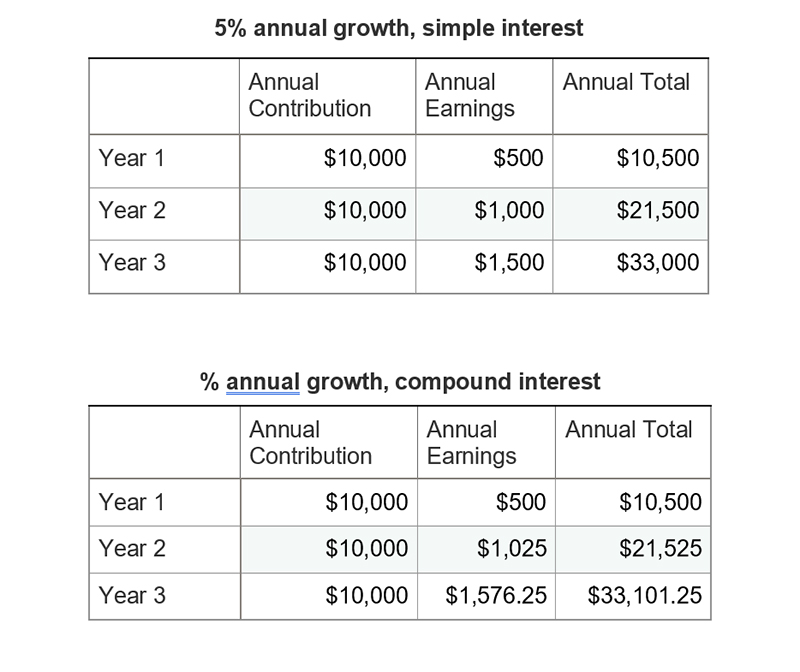

First, let’s look at how your benefit base will grow every year during the accumulation phase of the annuity, before you start receiving a payout. Your contract may refer to this as the benefit base rollup rate. It is separate from any interest rate you’ll be earning on your actual account value. The rollup rate may vary in how often it is calculated and how often it is added to your accumulated value. When compounded, the baseline value on which the rollup rate is calculated grows each year; otherwise, an unvarying value (which may be simply the total of your premiums paid, minus certain fees) will be used each year to figure the amount of growth in your benefit base.2

Here’s an example of what compounding means in real dollars. If you are funding an annuity by paying a total of $10,000 into it over the course of one year, and you earn 5% interest on it at the end of the year, that’s $500. Say that next year you receive 5% interest, compounded. That means 5% of $10,500 rather than 5% of the same $10,000, or earned interest of $525 rather than $500. If you are still funding it at $10,000 annually, you will have paid in $20,000 total for the second year and you’d receive 5% of $20,500 rather than 5% of $20,000, earning $1025 instead of $1000. The third year, assuming you continue your $10,000 contribution, you’d receive 5% of $31,525 instead of 5% of $30,000, earning $1576.25 instead of $1500. With compounded interest, annual growth increases by a larger amount every year. Without it, your pot still grows, but you don’t earn interest on your earnings.

As important as it is to understand the rollup rate and how it affects the growth of your benefit base, the payout rate may be even more important because it determines the amount that actually comes into your pocket once the payout phase begins.3

If you have an annuity with a guaranteed lifetime income rider that has grown to be $200,000, and you annuitize it at a 5% payout rate, that means you will get $10,000 per year for the rest of your life. If you annuitize it with a 6% payout rate, you’ll get $12,000 per year for the rest of your life. So if your life lasts 20 more years, your total lifetime payout would be $200,000 at the 5% payout rate and $240,000 at the 6% payout rate.

Citations.

1 - https://www.thebalance.com/what-is-an-annuity-income-rider-5187768

2 - https://www.forbes.com/sites/wadepfau/2020/07/08/deferred-variable-annuity-rollup-rates/

3 - https://www.kiplinger.com/article/retirement/t003-c032-s014-what-to-know-before-getting-annuity-income-rider.html